Social Security Information

Wondering where to start? Here are some preliminary Social Security resources for easy reference.

If you have Social Security questions about your specific situation, please feel free to call Michael at (203) 521-9671 for a FREE personalized consultation.

When is the right age to apply?

You can apply for your monthly retirement benefit between the ages 62 and 70. But when is the most advantageous time for you?

The age you apply for benefits will affect your final payment amount, which is calculated based on how much you’ve earned over your life as well as the age in which you apply, with your payment increasing the longer you wait to apply (or in other words, the closer you are to age 70). To better understand the implications of the age in which you apply, create an online account with the SSA.gov and get an estimate here of what your expected payment would be at different ages.

What information determines my monthly Social Security retirement benefit?

There are other factors in addition to age and lifetime earnings that also ultimately affect your monthly Social Security retirement benefit amount:

-

1960 and after - Age 67

1959 - Age 66 and ten months

1958 - Age 66 and eight months

1957 - Age 66 and six months

1956 - Age 66 and four months

1955 - Age 66 and two months

1943 - 1954 - Age 66

Healthcare: Any Medicare Part B medical insurance costs will be deducted from your monthly benefit amount. Only Medicare Part B will affect your payment; Medicare Part A hospital insurance is not considered.

Withholding Taxes: To determine your income amount, the SSA adds 50% of your benefit amount to your existing earned income at the time you apply for benefits. If your income is greater than $25,000 per year (individual) or $32,000 per year (joint), you will pay federal income taxes on your benefits. You can elect for these taxes to be withheld from your payment if you prefer not to pay the IRS directly. If you withhold taxes, your payment will be reduced.

When Your Full Retirement Age Is: The Social Security Administration considers Full Retirement Age at some point throughout your 66th year (after your 66th birthday and before your 67th). This date is used to calculate your monthly benefit payment and the benefits your family may also be able to claim. Use the dropdown to view the 2024 Full Retirement Ages (assuming birth dates on January 1st select the year before you were born - you can see these on the SSA website here).

Continuing to Work Before Full Retirement Age: If you are still working before your Full Retirement Age and you earn more than the current year’s earnings limit, your monthly benefit amount will be reduced temporarily. This only affects your benefit payment before Full Retirement Age - after, you can continue to work without any risk of lowering your benefit payment. If you’d like to see your annual earnings limit for 2024, use the calculator on SSA.gov here.

Claiming Spousal Benefits: If you are able to claim spousal benefits, the amount will max out at your Full Retirement age. This means that there is no benefit to waiting to claim these benefits past your Full Retirement age as they will not continue to increase. In addition, Survivor benefits may be claimed beginning at age 60 (or age 50 if you are disabled) if your spouse has passed away. You can use the following links on SSA.gov to learn more about Spouse Benefits and Survivor Benefits.

Working in Specific Jobs: Your monthly amount may be reduced if you claim a pension from a government job or worked in a foreign country during your career. You can see here how your pension may reduce your Retirement, Disability, Spousal and Survivor benefits. Farm, military, government, railroad and self-employment work amount other types have intricacies that will affect your monthly benefit. You can see if your job has special earnings rules here.

So, when exactly should I apply?

Now that you’ve determined the best age and month to begin claiming your benefits, it’s important to time your first benefit payment to prevent a potential gap in income.

You can submit your application to the Social Security Administration up to four months before you want to begin claiming your benefits. Please note that the month AFTER the month you select in your application is when your first check will arrive. For example, if you want your first check in hand in July, you should select June in your application (regardless of if you choose to apply in February, March, April, May or June).

Once you’re ready, you can apply for Social Security here on SSA.gov.

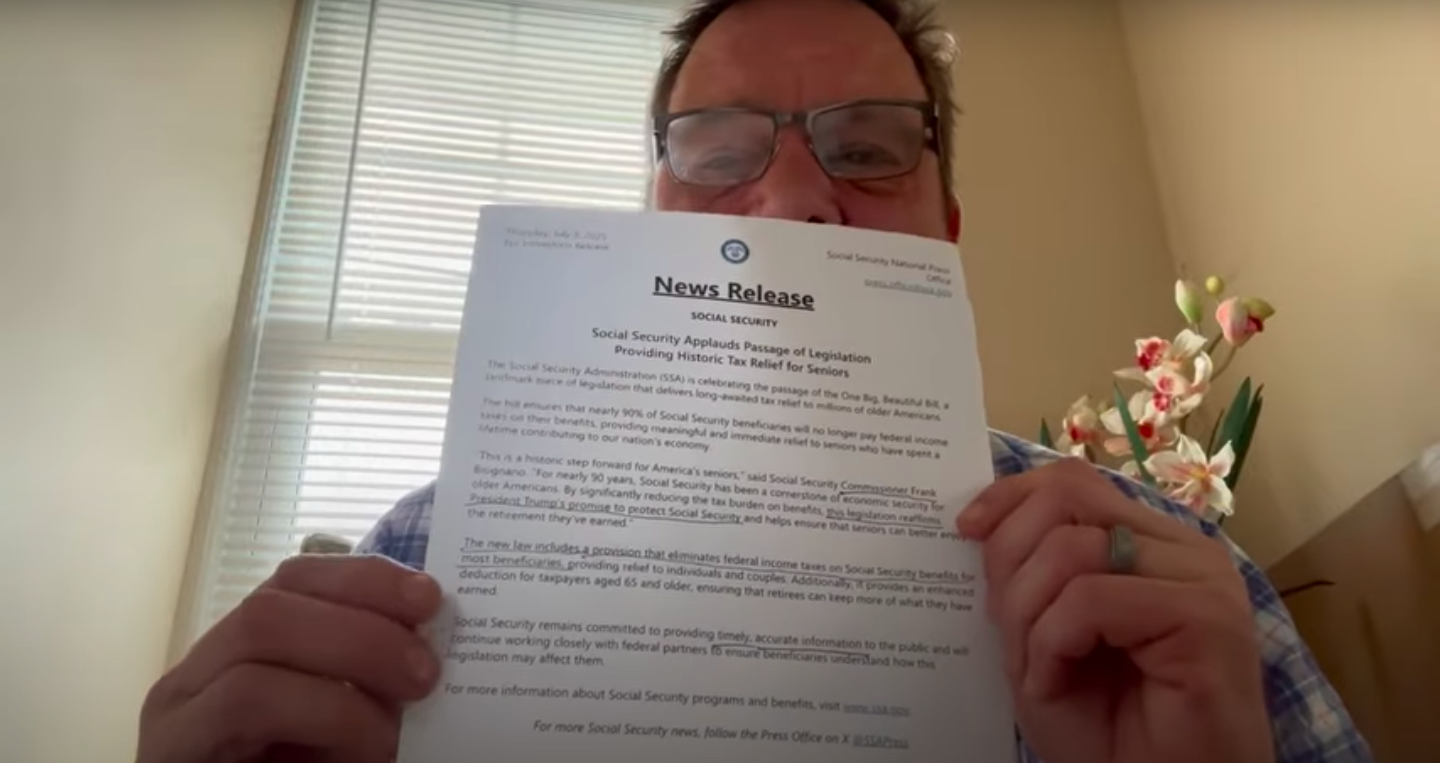

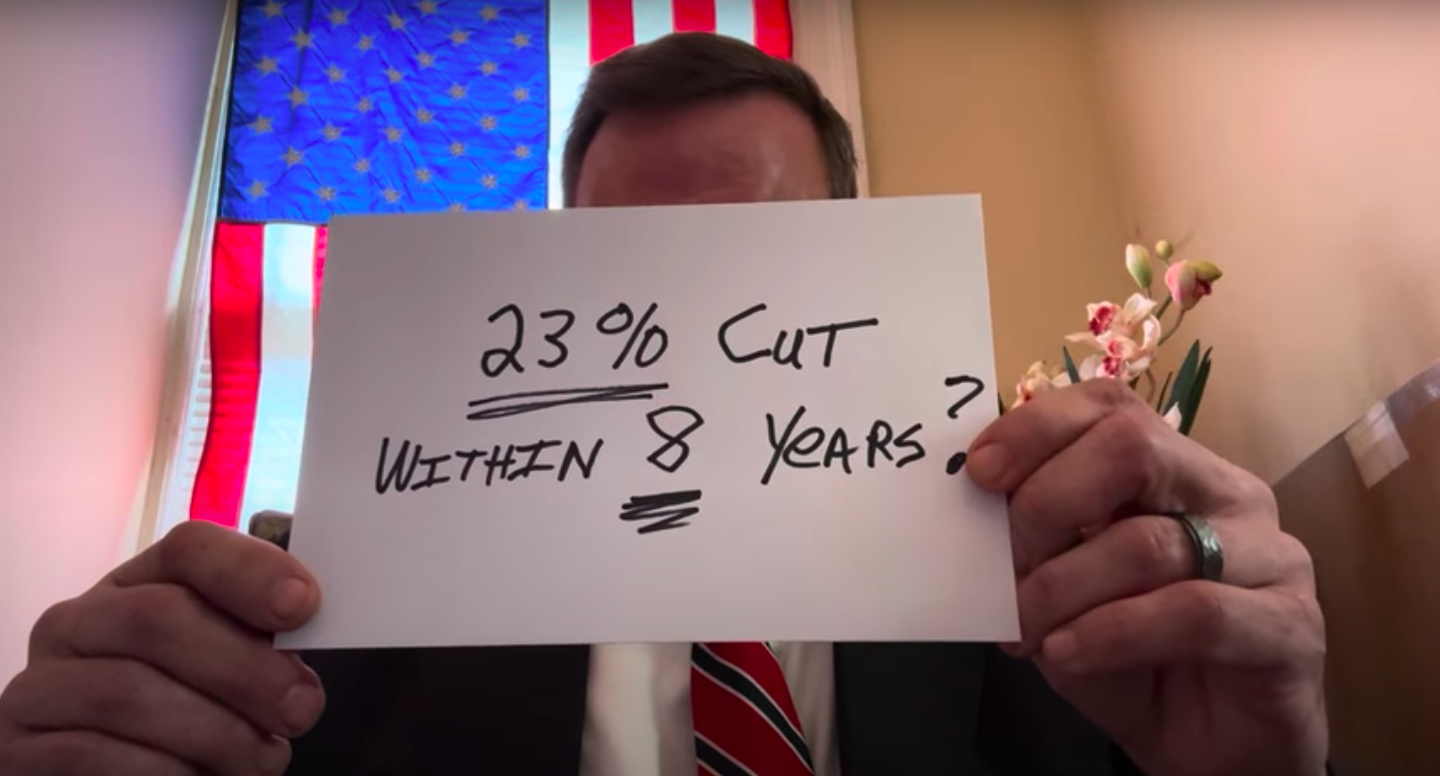

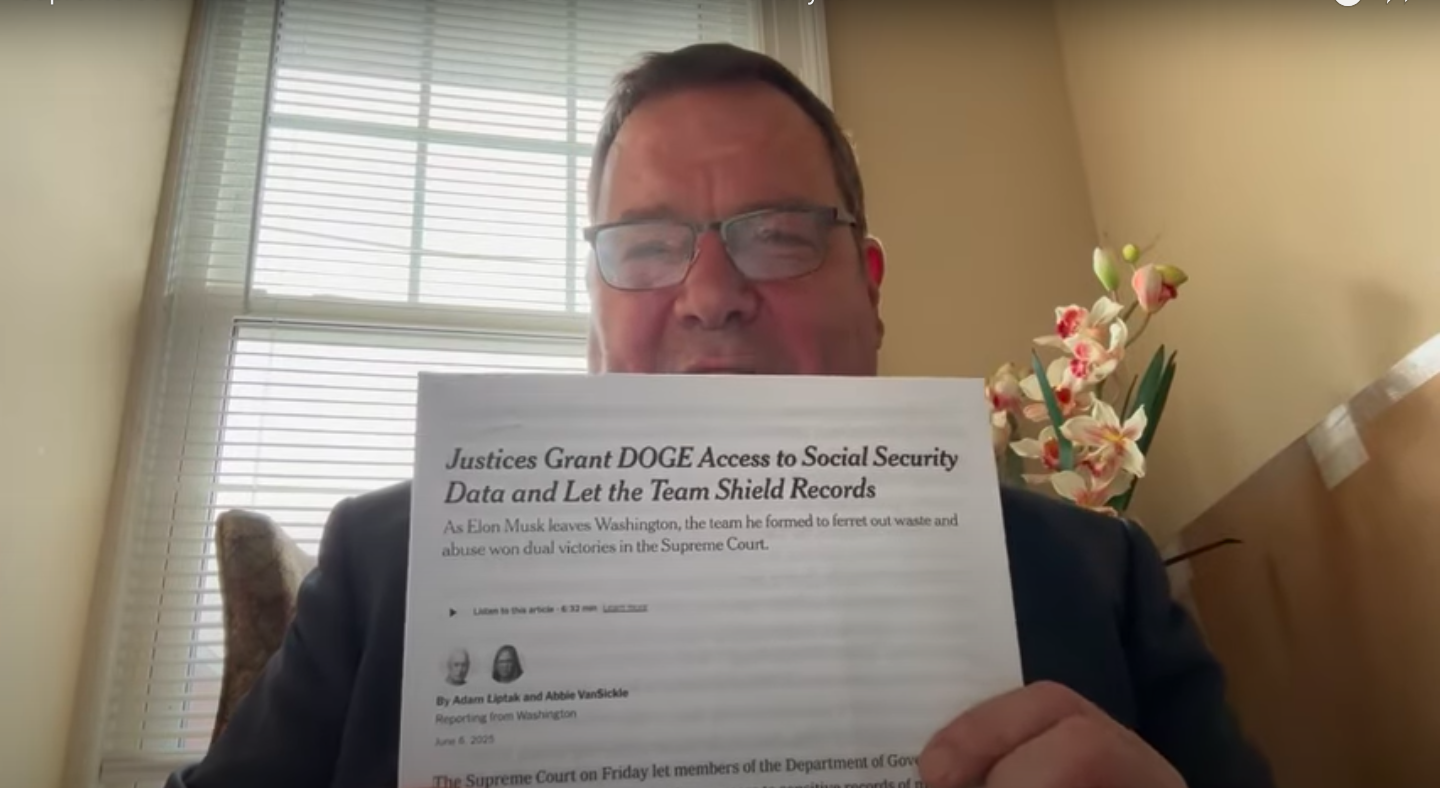

Looking for the latest on the Social Security Administration?

I go through several FAQs in the below video series with new topics posted on Tuesdays.